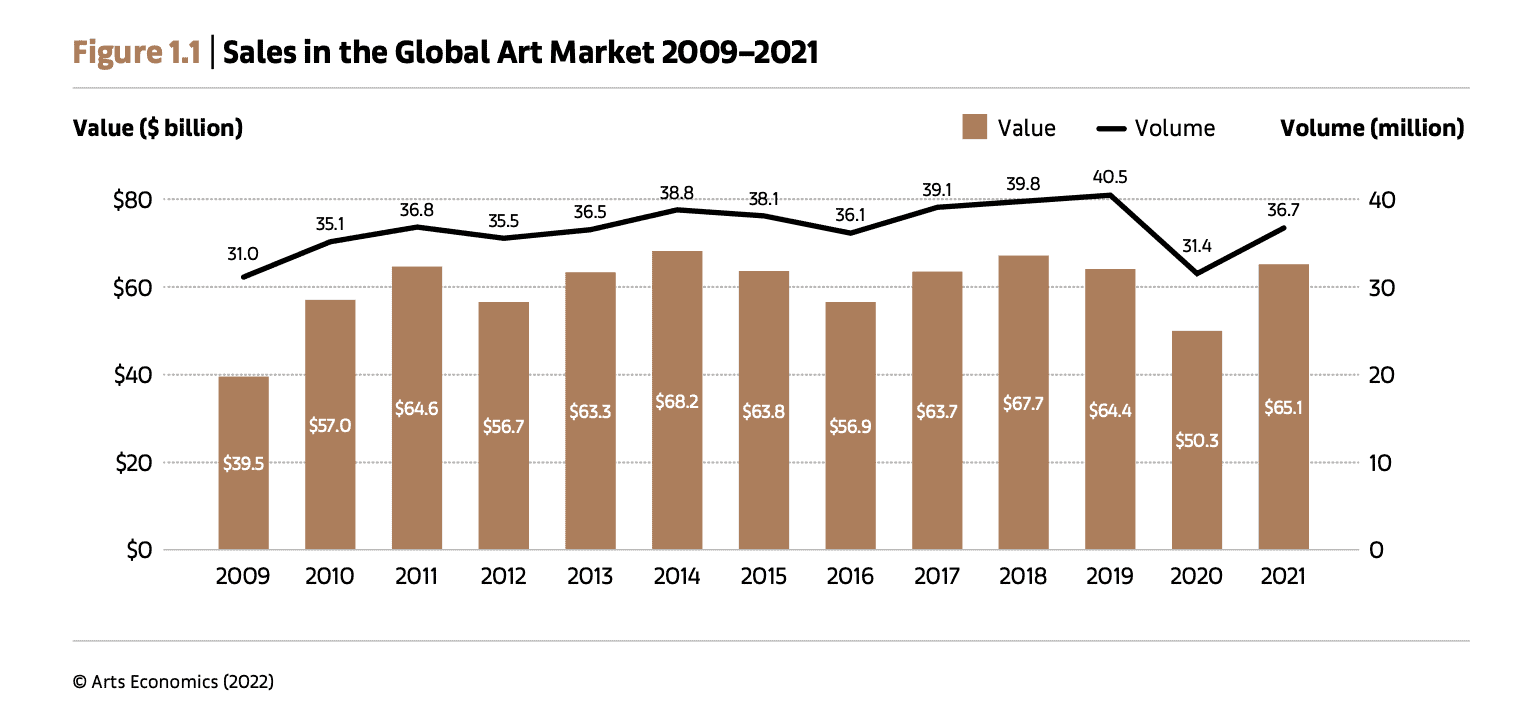

After suffering its worst recession in more than a decade in 2020 due to the strictures brought about by COVID-19, the art market rallied to a nearly unforeseeable degree in 2021, achieving a level even higher than that ofthe year before the pandemic started. Aggregate sales by dealers and auctioneers reached $65.1 billion, soaring by 29% from 2020, according to the 2022 Art Basel and UBS Global Art Market Report, written by the cultural economist and founder of Arts Economics, Dr. Clare McAndrew.

NFT-based art made an earth-shaking entry into the market in March 2021, when Beeple’s digital collage Everydays: The First 5000 Days sold at Christie’s New York for $69.3 million, making the artist, born Mike Winkelmann, the third most valuable living artist at auction. That sale was the tip of the spear; works based in the world of non-fungible tokens continued to reshape the market in the year’s remaining months.

Darkened galleries, auction sales rooms, and art fair halls drove much of the market online in 2020, and dealers and auction houses broadly adopted digital presentations and sales of their wares. But even as vaccines and other public health measures allowed societies to reopen in 2021, digital sales continued to grow.

While millions worldwide suffered financial losses as a result of the pandemic, the wealthiest only gained in value. The number of global millionaires and billionaires grew, and their percentage of the world’s wealth climbed higher. This meant that there was more disposable income among the wealthiest to support the art market, especially at the highest levels of dealers, who have access to these highly desirable buyers.

Here are seven takeaways from the report:

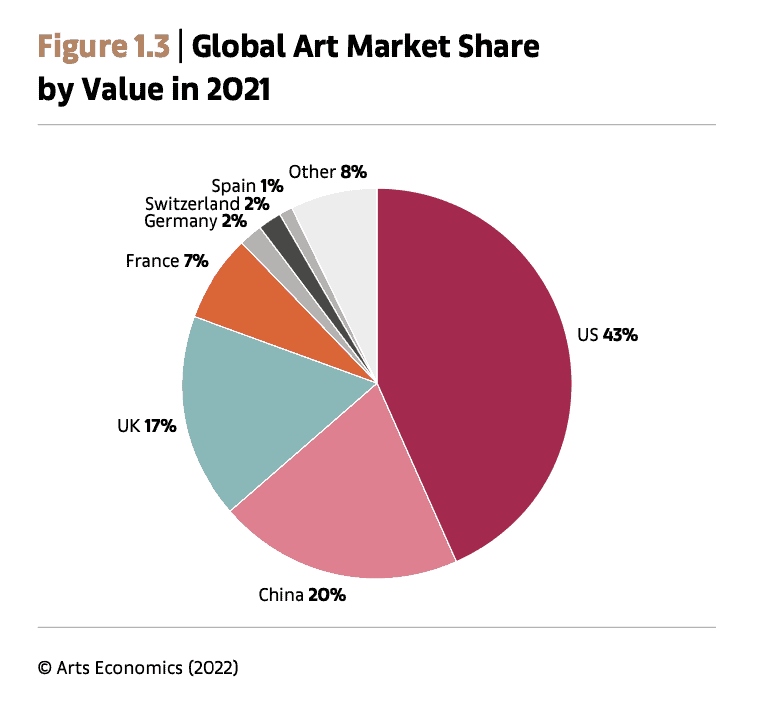

1. The US remains top dog.

The United States remained the largest single market, with sales rising by a third during 2021 to just over $28 billion. Though Greater China’s sales, which totaled $13.4 billion, grew by even more – just over one-third – it remained in the number two spot. The UK market grew by 14%, reaching $11.3 billion.

2. Dealer sales rebounded strongly but trailed 2019.

Dealers made a considerable recovery from 2020, with sales increasing 18% to $34.7 billion, but not achieving pre-pandemic levels. While they experienced the starkest declines in 2020, the high-revenue dealers saw the greatest recovery in 2021, fueled by strong demand for pricey works among the wealthiest collectors.

The average figure conceals a wide range of performance: The highest rise in value was among dealers with sales between $5 million and $10 million, who saw sales increase by more than a third (35%), while those with a turnover of less than $250,000 saw sales creep up by only 6% on average. Among the latter, only half reported any increase at all.

3. Auction houses experienced the strongest rebound, fueled by the newest art.

All sectors of the market grew from 2020 levels, but auctioneers saw the most dramatic recovery. Public sales increased by a remarkable 47% and private onesrebounded by about a third. The dealer market, by comparison, rose in value by 18%.

Postwar and Contemporary art continued to rule the roost, accounting for 55% of the value of global fine art auction sales, or $6.7 billion, an advance of 42% year-on-year. The newest of the new – works created in the past 20 years – accounted for more than a third (37%) of that value. Modern art was second, with 22%; its sales increased 23% in value to $2.7 billion and included the year’s top-selling lot, Pablo Picasso’s 1932 canvas Femme assise prèsd’unefenêtre (Marie-Thérèse), which fetched $103.4 million at Christie’s New York. Impressionist and Post-Impressionist art accounted for 15% of sales.

4. The shift online appears to be here to stay.

Even though dealers were able to reopen their galleries and resume showing at art fairs, and even as auction houses resumed something like their previous calendar of sales, the online market only expanded in 2021, climbing 7% to about $13.3 billion.

A market that had previously been slow to adopt digital strategies saw online sales account for fully a fifth of sales. While that number was down from 25% in 2020 it was still more than double the level of 2019 (which was 9%).

5. Beeple was just the beginning.

In the Before Times of 2019, sales of NFT art and collectibles on popular blockchains including Ethereum totaled $4.6 million – a respectable number, considering most people in the artworld wouldn’t have been able to explain what NFT stood for then.

But by the end of 2021 that number stood at a titanic $11.1 billion (which isn’t part of the $65.1 billion figure for the art market as a whole). Art-related NFT sales expanded by more than a hundredfold to $2.6 billion, fueled by other major post-Beeple sales –for example, a Tyler Hobbs work sold for$3.3 million in August 2021. (Collectibles also peaked that month, with two CryptoPunks selling for more than $4 million.)

Of the high net worth (HNW) collectors surveyed, a whopping 74% reported buyingart-based NFTs in 2021. They seem to have started small:The median spend on art- and collectibles-related NFTs was just $24,000, with just over a third, or $9,000, going on those linked to art.

6. But there’s a disconnect on NFTs.

There is a remarkable disparity, however, between the interest shown in NFTs by HNW collectors and the seeming interest of traditional artworld players in selling them.

Some 88% of the HNW collectors that the reportsurveyed are interested in buying NFT-based artworks in the future. But among dealers almost half had not sold works in this format and said they had no interest in doing so, suggesting that they are content to let others reap the rewards.

And while public auctions have created splashy headlines, the total NFT sales for Christie’s and Sotheby’s for 2021 ($150 million and $80 million, respectively, totaling $230 million) amounted to less than the total price of the three individually highest-priced works they sold in the same year ($288.7million for the aforementioned Picasso, a Basquiat, and a Botticelli).

7. The UK’s (Brexit) loss may have been EU nations’ gain.

In January 2021 the United Kingdom formally became the only sovereign country to depart the European Union, and what is often called the ‘self-inflicted wound’ became increasingly visibleover the course of the year. While the art market overall rebounded in 2021 to above 2019 levels, as mentioned the UK recovered by 14% year-on-year to $11.3 billion, but it still did not achieve parity with 2019 ($12.2 billion). It slipped back into third place, having been on par with Greater China in 2020 (and ahead in 2018 and 2019). It accounted for 17% of the market, its lowest share in a decade.

Imports were down by fully a third on 2019, and while much of that incoming trade from Europe went to the US, some may have bolstered European Union markets. France’s market saw a tremendous rebound, with sales rocketing by fully onehalf to $4.7 billion, the country’s strongest showing in a decade. Germany, Spain, and Italy also saw double-digit growth in value.

Brian Boucher is a writer and art market commentator based in New York City.

Originally posted 2022-09-15 10:23:46.